With 99% of Americans unable to buy the average house, more and more people are renting and getting less and less for their money.

Two thousand dollars per month is about what it costs for 400 sq. ft. of living space in many American cities.

Not only are you getting the short end of the stick with such a small space, but it often will eat up more than half your paycheck. With 99% of Americans unable to buy the average house, more and more people are renting and getting less and less for their money.

Previously, corporate landlords didn’t play in the single-family housing market, but they have been buying up traditional two- and three-bedroom homes at an astounding rate. It all ramped up with the Great Recession in 2008, when millions of homeowners ran into trouble with sub-prime loans and wound up in foreclosure. This was a golden opportunity for corporate real estate to swoop in and take advantage of the misfortune, buy these houses at rock bottom prices, and rent them back to the families that lost them.

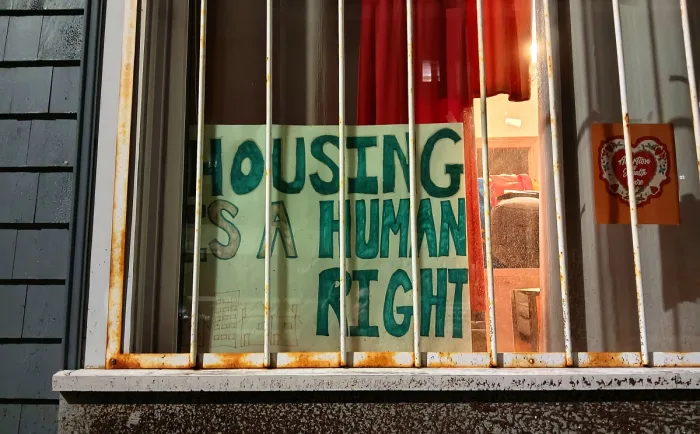

As living costs rise, many Americans are actively searching for the cheapest places to live in the U.S. and settle down. This reflects the deep-rooted belief that decent, modest housing is a fundamental American right, with homeownership as a cornerstone of middle-class financial stability. In today’s unpredictable market, owning a home offers a consistent expense and the opportunity to build equity. This starkly contrasts renting, where costs often increase faster than wages, offering no long-term financial gain.

I have the good fortune of living in a beautiful home that has greatly appreciated in value over the last 16 years. My mortgage is about what it costs for an average studio apartment. At the rate things are going, the haves will continue to prosper while the have-nots continue to suffer.

When I first moved to California in 1972, I lived in a very basic “bachelor” apartment for $100 a month, including utilities. I worked an entry level job that paid me $550 a month, so I paid less than 20% of my income in rent and still had enough for food and bus fare. Today, that same studio apartment would go for $1500, and the minimum wage would pay me $2700 a month. That gives most people no chance to get ahead.

The financial anxiety the majority of people feel is harming their mental health and making them cynical about our political system. How is California living up to its liberal image when it cannot guarantee affordable housing to such a large swath of its people? How can the richest state by wealth, with a gross domestic product of $3.8 trillion, be the poorest by virtue of the cost of living? How can a state with 178 billionaires have the highest percentage of people living in poverty? Is any effective action being taken to help?

Over the last three years, the state spent $24 billion on housing and homelessness, and yet the problem got worse. The cause is not that difficult to figure out: the rent is too damn high. Twenty-four billion dollars could have given 200,000 people a permanent place to live, rather than temporary shelter.

However, we simply are chopping off the top of the weed. We need to pull it out by the roots. The solution is keeping rents low and keeping people in their homes. For that, we need rent control, something we have the ability to expand in California this November by enacting Yes on 33 Act.

The opinions expressed here are solely the author’s and do not reflect the opinions or beliefs of the LA Progressive.